Rebuilding Lives After a Disaster

Disaster Relief helps homeowners recover after Federally-declared disasters like hurricanes, fires, floods, or tornadoes.

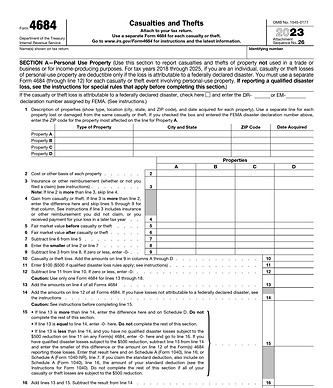

Using the Federal Casualty Loss Program (Form 4684),

we guide you to create tax deductions that can save thousands that you can use to rebuild.

Since 2017, we've helped over 10,000 homeowners,

like you, rebuild and get back on their feet.

How Disaster Relief Works

After disaster strikes, you may qualify for Federal Assistance Programs, including the Federal Casualty Loss Provision (Form 4684). This provision is designed to assist homeowners like you who have lost significant home value due to a Federally declared disaster, like a hurricane, wildfire, flood or tornado. The program allows you to deduct losses from your Federal taxes, reducing your tax burden.

Our free Tax Recovery Estimator can help you determine how much you might recover.

In order to participate in this program:

1. You must have suffered a loss in the Fair Market Value of your property as a result of a Federally declared disaster. This can include flooding, fire or wind damage.

3. You must be a taxpayer and, in some cases, you will need to itemize.

4. You need to substantiate your loss through an IRS-acceptable Loss Report or Home Appraisal showing both the pre and post value of your property.

That's where we come in. We provide a Disaster Loss Report for a cost of $250, regardless of the size of the loss or the amount of the recovery. Our reports cost substantially less that the price of a traditional appraisal and are delivered more quickly. If you cannot afford $250, please contact us through the Disaster Recovery Foundation where we make reports available free of charge.

CLICK HERE to order a Loss Report.

Once you have your Disaster Loss Report, you will have the information you need to file form 4684 with your taxes. The Loss Report is your substantiating documentation.

We recommend that you work with a tax professional as they may also recommend other tax-savings solutions.

If you don't have a tax professional, we can suggest one in your area.

Meet John and Kate. John is in sales and makes $50,000 per year. Kate works part time earning $25,000 per year. In 2019 they bought a house in Florida for $250,000. Since then, the market has been good and the house was worth $300,000 when Hurricane Ian hit in September of 2022. Their house was completely destroyed and the residual value of the land was about $50,000. They had $50,000 in insurance and now they've started to rebuild, but could use more help.

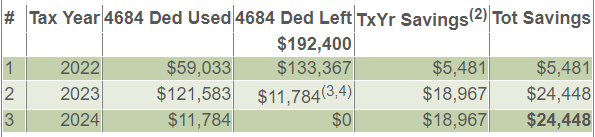

John and Kate used the Disaster Relief Tax Recovery Estimator and found out they could save $24,448 in taxes over the next several years:

For the first year, adding the Casualty Loss Deduction (the result of Form 4684), allowed the couple to completely eliminate their income taxes for 2022. In the 2023 tax season, John converted his $100,000 traditional IRA to a ROTH IRA at no tax cost. The next year they used the rest of the 4684 write off against their earnings for a total of $24,448 in savings.

The couple paid $250 for the report and $450 for tax preparation for 2022 and did their own taxes in 2023 and 2024. In the end they had an additional $23,748 to use in rebuilding their home.

Everyone's tax situation is different, so we've provided the Free Tax Recovery Estimator that you can use to see home much you can save.

If you're in Hawaii or Florida, we may already have your data loaded for Hurricane Ian and the Lahaina fires. If you're not in one of these state, you can call us at 505.490.2011 and we can give you guidance on the numbers to enter into the form.

Our Mission

The Federal Casualty Loss program has been part of the U.S. tax code since its inception. Today, it provides relief for owners whose homes suffer losses as a result of federally declared disasters, allowing them to deduct unreimbursed losses from their tax liability. This often allows taxpayers to recover taxes previously paid to help with immediate needs, and/or reduce their tax liability going forward.

Disaster Relief was created to provide victims of federally declared disasters with the appraisal they need to file IRS casualty loss claims, quickly and at a very nominal cost. We do this using proprietary technology in a transparent, defensible process that includes individual review by valuation techs. Disaster Relief’s Disaster Loss Report provides a competent appraisal for disaster-related loss in Fair Market Value (FMV). The IRS has accepted our reports, without challenge, since 2017 in over 10,000 cases.